FINANCIAL HIGHLIGHTS

-

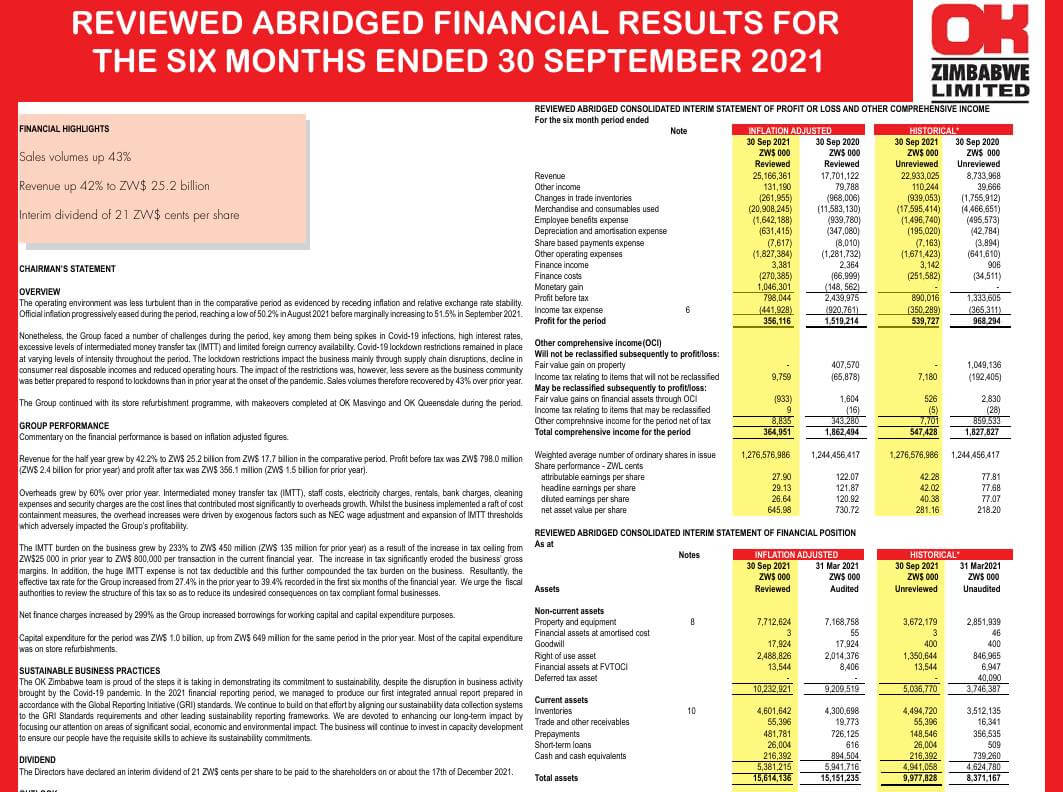

- Sales volumes up 43%

- Revenue up 42% to ZW$ 25.2 billion

- Interim dividend of 21 ZW$ cents per share

CHAIRMAN’S STATEMENT

OVERVIEW

The operating environment was less turbulent than in the comparative period as evidenced by receding inflation and relative exchange rate stability. Official inflation progressively eased during the period, reaching a low of 50.2% in August 2021 before marginally increasing to 51.5% in September 2021.

Nonetheless, the Group faced a number of challenges during the period, key among them being spikes in Covid-19 infections, high interest rates, excessive levels of intermediated money transfer tax (IMTT) and limited foreign currency availability. Covid-19 lockdown restrictions remained in place at varying levels of intensity throughout the period. The lockdown restrictions impact the business mainly through supply chain disruptions, decline in consumer real disposable incomes and reduced operating hours. The impact of the restrictions was, however, less severe as the business community was better prepared to respond to lockdowns than in prior year at the onset of the pandemic. Sales volumes therefore recovered by 43% over prior year.

The Group continued with its store refurbishment programme, with makeovers completed at OK Masvingo and OK Queensdale during the period.

GROUP PERFORMANCE

Commentary on the financial performance is based on inflation adjusted figures.

Revenue for the half year grew by 42.2% to ZW$ 25.2 billion from ZW$ 17.7 billion in the comparative period. Profit before tax was ZW$ 798.0 million (ZW$ 2.4 billion for prior year) and profit after tax was ZW$ 356.1 million (ZW$ 1.5 billion for prior year).

Overheads grew by 60% over prior year. Intermediated money transfer tax (IMTT), staff costs, electricity charges, rentals, bank charges, cleaning expenses and security charges are the cost lines that contributed most significantly to overheads growth. Whilst the business implemented a raft of cost containment measures, the overhead increases were driven by exogenous factors such as NEC wage adjustment and expansion of IMTT thresholds which adversely impacted the Group’s profitability.

The IMTT burden on the business grew by 233% to ZW$ 450 million (ZW$ 135 million for prior year) as a result of the increase in tax ceiling from ZW$25 000 in prior year to ZW$ 800,000 per transaction in the current financial year. The increase in tax significantly eroded the business’ gross margins. In addition, the huge IMTT expense is not tax deductible and this further compounded the tax burden on the business. Resultantly, the effective tax rate for the Group increased from 27.4% in the prior year to 39.4% recorded in the first six months of the financial year. We urge the fiscal authorities to review the structure of this tax so as to reduce its undesired consequences on tax compliant formal businesses.

Net finance charges increased by 299% as the Group increased borrowings for working capital and capital expenditure purposes.

Capital expenditure for the period was ZW$ 1.0 billion, up from ZW$ 649 million for the same period in the prior year. Most of the capital expenditure was on store refurbishments.

SUSTAINABLE BUSINESS PRACTICES

The OK Zimbabwe team is proud of the steps it is taking in demonstrating its commitment to sustainability, despite the disruption in business activity brought by the Covid-19 pandemic. In the 2021 financial reporting period, we managed to produce our first integrated annual report prepared in accordance with the Global Reporting Initiative (GRI) standards. We continue to build on that effort by aligning our sustainability data collection systems to the GRI Standards requirements and other leading sustainability reporting frameworks. We are devoted to enhancing our long-term impact by focusing our attention on areas of significant social, economic and environmental impact. The business will continue to invest in capacity development to ensure our people have the requisite skills to achieve its sustainability commitments.

DIVIDEND

The Directors have declared an interim dividend of 21 ZW$ cents per share to be paid to the shareholders on or about the 17th of December 2021.

OUTLOOK

The Group is confident of recovery and growth prospects in the remainder of the financial year. The relaxation of Covid-19 induced lockdown restrictions is expected to positively impact on Group revenues and profitability. The vaccination drive continues to give hope that the pandemic will be brought under control in the medium term. Although the pandemic continues to pose risks, the Group has put in place sufficient mitigatory measures to enable it to operate in a sustainable and responsible manner, ensuring the safety of its staff, customers, supplier partners and all other stakeholders.

The forecast good rains in the 2021/22 agricultural season and positive developments in the mining and manufacturing sectors of the economy, should result in an upturn in real disposable incomes and consumer spending, which presents opportunities for the Group. Further, the Group’s expansion drive continues, with a number of new stores and refurbishments expected to be accomplished before the end of the financial year. The Group embarked on a leadership renewal process which has seen the successful placement of new Executive Directors to lead Finance, Marketing, Human Resources, Supply Chain and Operations.

Towards the end of the reporting period, inflationary pressures gathered momentum with the official month-on-month inflation which had averaged 3.2% per month during the period rising to 6.4% for the month of October 2021. The authorities intervened with measures to control the growth of money supply and discourage speculative behaviour in the market. The Group is optimistic of the success of the measures taken by monetary authorities to curtail money-supply growth and its negative impact on inflationary pressures.

DIRECTORATE

During the first half of the financial year, the Group began a transformative journey of leadership renewal in accordance with the overall succession plan. The Group bade farewell to its long serving stalwarts, Messrs Alex Edgar Siyavora and Albert Rufaro Katsande on 31 March 2021 and 30 June 2021 respectively. With their retirements, Messrs A. E. Siyavora and A. R. Katsande retired from the Board of Directors of the Company. On behalf of the shareholders, Board of Directors, management and staff, I wish to convey the Group’s appreciation for their years of dedicated service to the Group.

On 1 April 2021, the Group welcomed Mr. Maxen Phillip Karombo as Group Chief Executive Officer. Furthermore, Mr. Phillimon Mushosho joined as Group Chief Finance Officer on 1 July 2021. Messrs M. P. Karombo and P. Mushosho both joined the Board of Directors as Executive Directors with effect from their respective dates of appointment. The Board also welcomed Mr. Simon Masanga as a Non-Executive Director on 1 April 2021. Join me in congratulating Messrs M. P. Karombo, P. Mushosho and S. Masanga and wishing them great success in their new capacities.

H. NKALA

CHAIRMAN

26 November 2021