Chairman’s Statement

Dear Shareholders

I wish to start by unreservedly apologising to you all our shareholders for the delay in the publication of the financial results for the year ended 31 March 2023. This delay, was occasioned by the technical challenges experienced during the implementation of a new Enterprise Resource Planning (ERP) system. However, I am pleased to advise that the technical challenges have now been resolved and measures have been taken to ensure that the Group will publish financial results within its usual timeframes and in compliance with the regulations going forward.

The operating environment of the reporting period presented significant challenges to business largely driven by exchange rate volatility and high inflation. The annual inflation which was recorded at 96% at the beginning of the financial year, peaked at 280% by September 2022 before declining to 87.6% as at 31 March 2023 following the blending of ZWL and USD inflation computations. The inflationary pressures were primarily caused by the steep volatility in exchange rates. Consumer disposable incomes were adversely impacted by rising prices of goods and services as suppliers sought to preserve value by indexing ZWL prices to foreign currency price pegs. The multiplicity of exchange rates posed a huge arbitrage challenge on both the supply and selling sides of retail business. Our key suppliers shortened their trading terms to formal retail resulting in the loss of volumes to the informal sector who were offering competitive pricing in foreign currency as they do not face the regulatory limitations that are placed on formal retailers.

The fiscal and monetary authorities implemented a raft of measures to stem the economic deterioration that was experienced in the economy by significantly increasing interest rates to mop up excess liquidity. Borrowing costs peaked at 200% before eventually easing off to levels around 80% per annum. A new “Willing Buyer, Willing Seller” platform was eventually introduced to manage foreign currency exchange rates. These moves by the authorities resulted in some relative stability, although more still needs to be done to create a more sustainable and predictable operating environment.

Notwithstanding this, the Group showed resilience and continued to forge ahead with the strategic repositioning of its offering. The strong partnerships with suppliers, banks and others, helped the business to continue forging ahead.

Group Performance

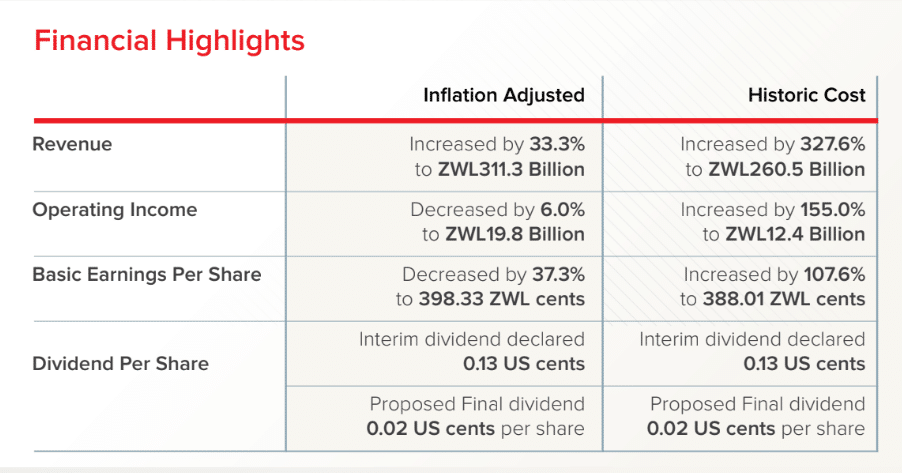

The commentary on the financial performance is based on inflation adjusted results. Historical cost figures are included as supplementary information alongside the inflation adjusted results to enhance comprehension and analysis.

Revenue for the year grew by 33.3% to ZWL311.3 billion from ZWL233.6 billion in the comparative period. In historical cost terms, revenue grew by 327.6% to ZWL260.5 billion from ZWL60.9 billion. Volumes for the year declined by 7.7% over the comparative period owing to local currency liquidity shortages and depressed consumer spending power. The informal sector continued to expand at the expense of the formal retail sector as a result of exchange rate distortions in the market.

Profit after tax decreased by 36.0% to ZWL5.2 billion (Last year: ZWL8.1 billion) whilst in historical cost terms, the the profit after tax increased by 111.7% to ZWL5.1 billion (Last year: ZWL2.4 billion). The profit performance was impacted by the increase in operating costs arising from increased usage of generator fuel due to acute power outages, inflation pressures embedded in forward pricing by market players, as well as exchange rate induced cost increments on labour, cleaning and security costs. The Group has taken measures to reduce and contain costs to improve its profitability going forward.

The Group utilised borrowings to fund its strategic growth initiatives in accordance with its medium to short-term growth plans. The increase in the interest rates resulted in the net finance charges growing by 99.7%.

Capital expenditure for the year was ZWL6.1 billion down from ZWL8.9 billion in the prior year. Most of the capital expenditure was channelled towards store refurbishments. In addition, there was an acquisition of a subsidiary amounting to ZWL3.7 billion.

The Board has taken note of the matters raised by the External Auditors in their audit opinion.

Enterprise Resource Planning System (ERP) Project

At beginning of the financial year, the business embarked on a project to upgrade its Enterprise Resource Planning (ERP) system to strengthen its reporting and internal control environment. During the implementation phase of the Microsoft Dynamic 365 (MSD365), the system experienced unexpected technical challenges that required to be resolved by the system developers. The reconfiguration of some aspects of the ERP system caused significant delays in the processing and data warehousing of the business’ transactions. These unforeseen delays consequently impacted on the finalisation of the year end audit hence the delay in the publication of the financials results.

Notwithstanding these technical challenges that were experienced during the roll out phase, I am pleased to advise that these have now been resolved. The system is now working as expected. The Group will continue to optimise the new ERP system to maximise the benefits derived from this important investment. The new ERP system will form the bedrock of the group’s innovation thrust going into the future. This will result in improved customer service offering, automation of processes and procedures as well as seamless integration with suppliers, banks and other key stakeholders for operational efficiencies.

Acquisition of Food Lover’s Market

During the year, the Group successfully concluded the strategic acquisition of the Food Lover’s Market business in Borrowdale, Avondale and Bulawayo’s Bradfield shopping centre after receiving the necessary regulatory approvals. This acquisition, which comes with a Territorial License Agreement for the Zimbabwean territory, will bolster the Group’s strategic thrust to expand its footprint in the premium segment of the market. This will see the Group refreshing the existing stores and expanding the brand representation in the territory. The addition of the Food Lover’s Market franchise arrangement will create further supply chain and logistics optimisation that will benefit the entire Group with premium product offering.

Directors

The Group appointed Mr Wonder Stan Nyabereka as a Non-Executive Director with effect from 1 June 2022. Join me in congratulating Mr W. S. Nyabereka and wishing him success in his new role.

Sustainability

A core part of our strategy is making a tangible and lasting impact on employees, suppliers, shareholders, communities, businesses and the environment in which we operate. During the year, we began a process to gain a greater understanding of our impact and to systematically assess the risks and opportunities that are presented to our business by climate change. As part of these efforts, we are putting in place new frameworks and procedures, which also have application beyond environmental matters and will strengthen our Company’s sustainability drive.

Dividend

The Board of Directors has declared a final dividend of 0.02 USD cents per share for the year ended 31 March 2023.

Outlook

The operating environment remains constrained with the local currency liquidity challenges continuing to negatively impact formal retail volume performance. The exchange rate volatility, high inflation and interest rates remain significant challenges facing the business. Overheads continue to rise driven by wage inflation and the growth of utilities and service industry expenses. The Board and Management remain vigilant in protecting the Group from the relentless shocks arising from the volatile economic environment.

I would like to thank you, our shareholders for your support and patience during the new ERP system implementation phase.

H. Nkala

Chairman

26 September 2023