Financial Highlights

Chairman’s Statement

Dear Shareholders

The first half of our Financial Year (F23) witnessed a very volatile trading environment that was characterised by episodes of extreme exchange rate volatility that resulted in high inflation. The annual inflation which was recorded at 96% at the beginning of the financial year, rose to 280% at the close of the half year as at 30 September 2022. Due to mounting inflationary pressures, instore product pricing became difficult to execute. This was aggravated by suppliers’ shortened trading terms or in extreme cases demand for prepayments for products sourced in local currency. The period also saw manufacturers increasing product supply to channels offering hard currency competitiveness rather than formal retail chains where mandatory use of the legal exchange rates led to significant price premiums.

Faced with worsening economic fundamentals, the Fiscal and Monetary authorities instituted measures to stem the deterioration that was attributed to market indiscipline. Interest rates were hiked from a range between 40% and 80% to levels above 200%. Although inflation slowed down in the short term, it remains unsustainably high. Commendable action was taken by Government in dealing with over-pricing of goods and services by contractors of major national projects. As the market re-priced, a severe shortage of ZWL birthed a new liquidity crunch that continues to impact on consumer aggregate demand.

Notwithstanding this, the Group’s focus remained on the strategic repositioning of its offering in the face of significant economic headwinds. The strength and agility of our business, combined with the professionalism and resilience of our teams and partners, enabled the Group to continue delivering a commendable operational performance.

Group Performance

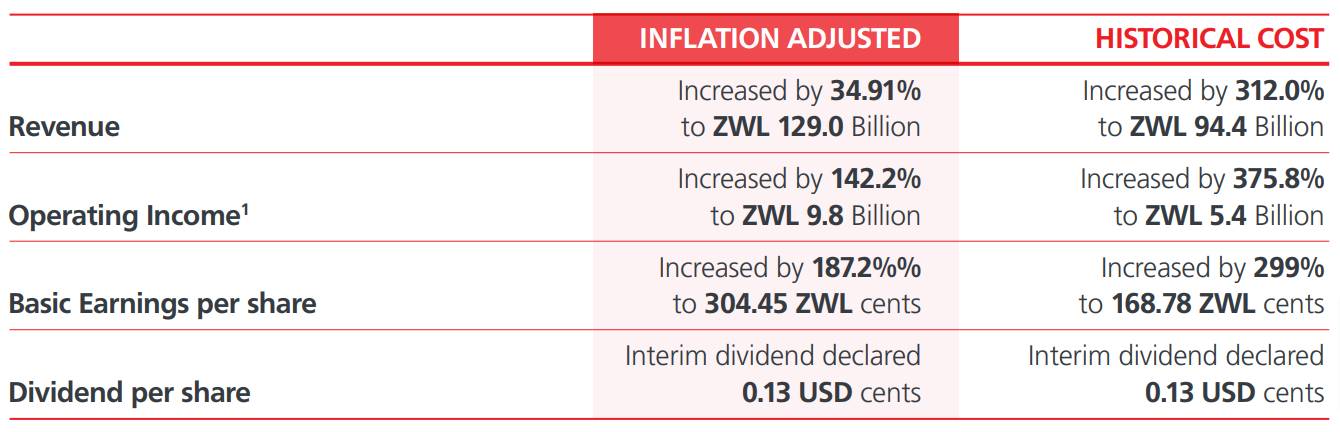

The commentary on the financial performance is based on inflation adjusted results. Historical cost figures are included as supplementary information alongside the inflation adjusted financial results to enhance comprehension and analysis.

Revenue for the half year grew by 34.91% to ZWL 129.0 billion from ZWL 95.6 billion in the comparative period (in historical cost terms, revenue grew by 312%). Volumes, which had marginally grown by 1% during the first quarter, declined during the second quarter to result in a net decrease of 8.23% over the half year owing to depressed consumer spending power.

Profit before tax for the period increased by 150% to ZWL 7.6billion (Last year: ZWL 3.0 billion) translating to a profit margin of 5.88%. In historical cost terms, profit before tax was ZWL 3.5 billion (Last year: ZWL 0.9) representing a 300% increase. Profit after tax increased by 193% to ZWL 4.0 billion (Last year: ZWL 1.4 billion) whilst in historical cost terms, the net profit increased by 307% to ZWL 2.2 billion (Last year: ZWL 0.5 billion).

The Group utilised borrowings to fund its strategic growth initiatives in accordance with its medium to short-term growth plans. The increase in interest rates resulted in the net finance charges increasing by 119%.

The IMT tax continued to burden the business, growing by 245% to ZWL 1.6 billion in historic cost terms (ZWL 450 million for prior year) following the widening of the tax ceiling. This IMT tax, which was also extended to foreign currency transactions during the period, increased business costs and tax burden as it is not tax deductible. The business is continuously engaging fiscal authorities to review the structure of this tax so as to reduce its undesired consequences on tax compliant formal businesses.

Capital expenditure for the period was ZWL2.1 billion, down from ZWL 3.9 billion in inflation adjusted terms for the same period in the prior year. The capital expenditure was largely deployed on store refurbishments. During the period under review, the Group carried on with its branch refurbishment program and one was completed. Several projects will commence in the second half of the financial year to bolster our competitiveness and improve customer proposition.

The Board has taken note of the two matters raised by the External Auditors in their review conclusion and are satisfied that these have subsequently been resolved and will not recur going forward. The Board is satisfied that save for these two matters, all other financial information as fully contained in the External Auditors’ Report is fairly stated in all material respects.

New Business Operations

During the reporting period, the Company commenced negotiations for the acquisition of the Food Lovers Market business in Borrowdale, Avondale and Bulawayo. The negotiations included the acquisition of a Territorial License Agreement that will see the Company refreshing the existing stores and expanding the brand representation in the Zimbabwean market. Subsequent to the reporting period, Management received the requisite regulatory approvals and is now proceeding to conclude the transaction. The acquisition is well aligned to the new strategy of augmenting the Group’s premium offering.

The same period also saw the Company conceptualising and registering a new instore pharmaceutical offering under the name and style of Alowell Pharmacies. The Group expects to commence rolling out the new pharmacies during the festive season of 2022. Detailed communications on these developments will be circulated in press publications in due course.

Sustainable Business Practices

As a responsible corporate citizen, the Group acknowledges the need to balance our business performance with responsible environmental and social considerations. The Group’s sustainable development practices are critical in generating long-term value creation for all our stakeholders. During the period under review, our efforts were designed to support the United Nations Sustainable Development goals. We are on course to meet our targets in respect of the six Sustainable Development Goals that we contribute to namely, Good Health and Well-being, Clean Water and Sanitation, Affordable and Clean Energy, Decent Work and Economic Growth, Reduced Inequalities, Responsible Consumption and Production.

Dividend

The Directors have declared an interim dividend of 0.13 US cents per share to be paid to the shareholders on or about the 20th of January 2023.

Corporate Governance and Directorate

The Group has consistently practiced good corporate governance, reflecting its belief that robust governance practices, processes, and culture are fundamental to inspiring investors’ confidence, ensuring long-term shareholder value and protecting stakeholders’ interests.

During the first half of the financial year, the Group welcomed Mr Wonder Stan Nyabereka to the Board of Directors with effect from 1 June 2022. Join me in congratulating Mr. Nyabereka on his appointment to the Board and in wishing him great success during his tenure.

Outlook

Looking ahead, the interplay between exchange rate and inflation factors will continue to impact on overall aggregate demand. The country faces a severe shortage of electricity generation capacity that is likely to have an adverse impact on operations. Use of diesel-powered generators for cooling and baking in our stores will increase operational costs. We urge Government to provide relief mechanisms on diesel price in the short term and also provide incentives for private sector investments in renewable energy sources. The Group remains positive that its volume recovery initiatives will positively impact on financial performance to deliver sustainable profitability.

Herbert Nkala

Board Chairman

21 December 2022

Reviewed Condensed Financial Results for the six month period ended 30 September 2022.pdf